|

| Photo from TheEdgeProperty |

Just like how retailers offer discounts to keep sales up during a slow period, developers also have a few tricks up their sleeves to sell their properties amidst the current unfavourable economic climate. Besides attractive promotions and perks to draw buyers, some companies are open to bulk sale and underwriting deals, in which purchasers can enjoy reduced prices.

The slowdown has seen some developers accepting bulk sales as minimal as 10 units, says Malaysian Institute of Estate Agents (MIEA) national vice-president Lim Boon Ping. “The number of units were much bigger when the market was better, but things have changed,” he tells TheEdgeProperty.com.

CBD Properties group managing director Datuk Adrian Wang concurs that buyers and investors will definitely be getting more bulk purchase opportunities in a market slowdown as some developers may be laden with a high number of unsold units.

Compared with property underwriting deals, developers will often offer higher price cuts in a property bulk sale as it usually involves a group of genuine buyers or investors, Wang points out.

“There is more uncertainty in property underwriting deals because they may not be able to sell all the units underwritten.”

Although buyers can get more discounts under bulk buying, Wang warns buyers to be careful. “You can buy a property at a lower price today, but you might lose more in the future because there could be other possibilities behind the cheaper prices.”

For instance, the properties might be sitting in an unfavourable location, or it may turn out to be of bad quality, or may even end up being abandoned by the developer.

As such, he urges buyers to not just focus on the price of a property but also take note of its location and the developer’s reputation. “You can buy at a higher price, but you should never buy in a wrong location,” he stresses.

MIEA’s Lim also does not encourage normal buyers to take part in bulk buying due to the possible risks involved.

“With the tightened lending policy by banks, it is very difficult for property buyers to get a loan. In view of this, if one buyer in a group that has already reached an agreement with a developer to do property bulk purchase fails to get a loan, the group has to find someone to replace the buyer or the entire deal will have to be re-negotiated,” he explains.

If this problem cannot be solved within a certain period, the bulk purchase deal will lapse and the developer will forfeit the deposit. Hence, Lim doesn’t think it is worth the risk.

There is also a risk of the developer giving a different discount when they sell the property to other buyers, he adds.

What is property bulk purchase?

However, for some real estate negotiators such as Chester Properties Sdn Bhd group marketing director Jei Chew, there are several benefits to bulk buying through a real estate agency.

It is easier to negotiate with a developer as a group as a normal buyer may lack confidence negotiating with the developer. On top of that, a developer may be reluctant to take the risk of dealing with a group of strangers, unless they have reputable investors in the group.

Generally, bulk buyers could receive discounts of between 3% and 5% after negotiations, says Chew.

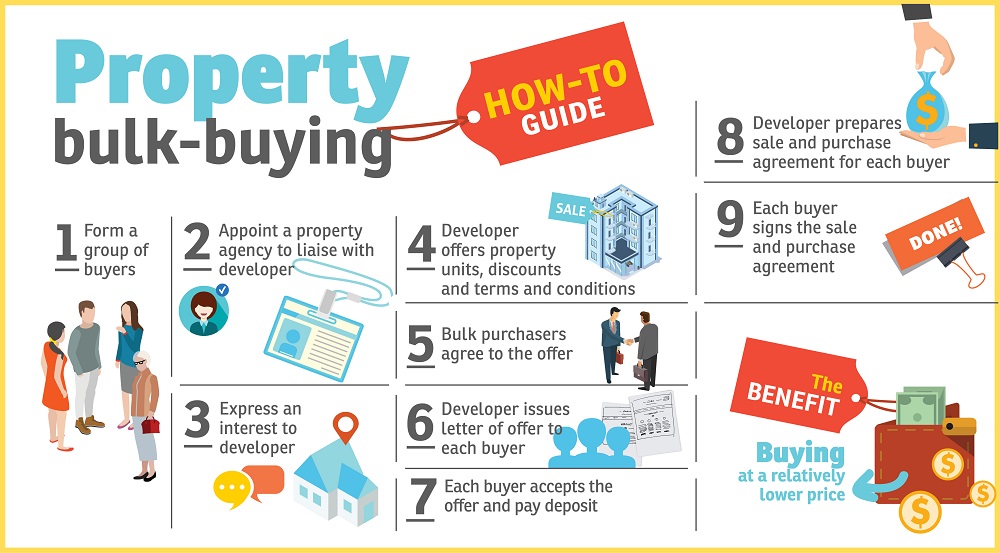

Upon receiving the interest from buyers, a developer will offer the property units available for the bulk purchase, the proposed discounts and related terms and conditions, says Wang.

The developer will then issue a letter of offer to each buyer once all of them have agreed on the offer. Once the letter of offer is accepted, each buyer has to pay the deposit, after which the developer will prepare the Sale and Purchase Agreement for each buyer, explains Wang.

“For a group of buyers who are unfamiliar with the process, they might want to appoint a property agency to help them negotiate with the developer,” he suggests.

According to Chur Associates founder and lawyer Chris Tan, an entity such as an individual person, private firm or a limited liability partnership that buys more than four units is considered bulk buying and the developer has to register the sale with the Urban Wellbeing, Housing and Local Government Ministry.

“This is a guideline issued by the ministry and sometimes it will appear as a condition under the advertising permit and developer’s licence,” he adds.

KL New Bangsar, New Innovative, New Lifestyle

Service Suites with 5 Star Facilties !!!

Register your interest >> https://goo.gl/forms/H3Ed8AuubgxBilRi2

Service Suites with 5 Star Facilties !!!

Register your interest >> https://goo.gl/forms/H3Ed8AuubgxBilRi2

Unique Propositions :

★ Perfectly located at Centre of Gravity

★ Desirable mature prime address

★ New Lifestyle & New Digital Life

★ Well connected to public transport link

★ Well connected to major arterial expressways

★ Minutes away from Midvalley, Bangsar and KL Ecocity

★ Developed by Branded developer with strong track record

★ Perfectly located at Centre of Gravity

★ Desirable mature prime address

★ New Lifestyle & New Digital Life

★ Well connected to public transport link

★ Well connected to major arterial expressways

★ Minutes away from Midvalley, Bangsar and KL Ecocity

★ Developed by Branded developer with strong track record

or contact us at 012-5070131 (Angel)